Economic data releases – UK Inflation at near 6 year high

13 December, 2017

Matthew Boyle

The big news in economic data releases yesterday was that UK inflation in November rose to 3.1% – the highest this has been in nearly 6 years, with the ONS suggesting it was airfares and computer games that contributed to the rise. With recent data showing the UK weekly wage is growing at a rate of 2.2% this could be a cause for concern. And given this figure is outside the 1-3% threshold, this will now trigger a letter from Bank of England Governor Mark Carney to Chancellor Phil Hammond, which will detail how he intends to bring the figure back down to its 2% target. Some are suggesting this may well pave the way for another interest rate hike in the UK, however given we only saw a hike last month it is unlikely, particularly given that previously Mark Carney warned he expected inflation levels to peak at this time. However, the prospect of it seemed to do GBP a favour particularly against EUR, and throughout the day’s trading gained half a cent against the single currency. Against the USD, GBP remained flat throughout the day as markets await the highly anticipated FED interest rate decision today, where many are expecting the US to hike rates. This was demonstrated in USD/EUR cross with the greenback gaining almost a cent throughout the day. Given the probability of a US hike in rates, and that we are unlikely to see another UK one announced by the MPC when they meet on Thursday, readers with an imminent requirement may want to take advantage of the spike against EUR or at current USD levels should we see a hike and the rate drop.

The big news in economic data releases yesterday was that UK inflation in November rose to 3.1% – the highest this has been in nearly 6 years, with the ONS suggesting it was airfares and computer games that contributed to the rise. With recent data showing the UK weekly wage is growing at a rate of 2.2% this could be a cause for concern. And given this figure is outside the 1-3% threshold, this will now trigger a letter from Bank of England Governor Mark Carney to Chancellor Phil Hammond, which will detail how he intends to bring the figure back down to its 2% target. Some are suggesting this may well pave the way for another interest rate hike in the UK, however given we only saw a hike last month it is unlikely, particularly given that previously Mark Carney warned he expected inflation levels to peak at this time. However, the prospect of it seemed to do GBP a favour particularly against EUR, and throughout the day’s trading gained half a cent against the single currency. Against the USD, GBP remained flat throughout the day as markets await the highly anticipated FED interest rate decision today, where many are expecting the US to hike rates. This was demonstrated in USD/EUR cross with the greenback gaining almost a cent throughout the day. Given the probability of a US hike in rates, and that we are unlikely to see another UK one announced by the MPC when they meet on Thursday, readers with an imminent requirement may want to take advantage of the spike against EUR or at current USD levels should we see a hike and the rate drop.

Today’s Economic data releases – US Interest rate hike?

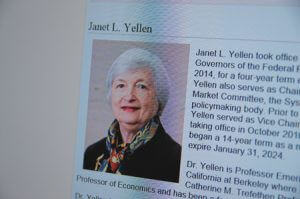

Today we have number of economic data releases in the morning, including German inflation data, UK unemployment ecostats, and Eurozone Industrial Production. However, all eyes will be fixed upon the US for those of you sending money to the USA…in the early afternoon they release inflation data, which then paves the way for the heavily anticipated FED economic projections, and their interest rate decision. Many analysts are suggesting we are likely to see a hike, which will be the 3rd of the year and the last time FED Chair Janet Yellen presides over a policy change, as President Trump has opted to replace her in February. Should the FED increase the rate again we would expect the USD to strengthen and rates to buy USD drop across the board. Market analysts will also be focussing on the wording of the statement today for any clues as to what might happen next year, and how fast rates may rise in the future. Most suggest there will be a further 3, but some analysts have suggested it could be 4, and will be watching also for any clues of potential tax cuts on the horizon.

With the FED announcement coming in the early evening, those of you reading this might like to consider the movement we might see following the result and take out the risk that poses from your transfer. With GBP>EUR around a cent off the best it has been in 6 months, and USD flat as traders await the news, tonight could see big movements across the board, and ones which might greatly increase the cost of your transfer or potential property purchase.

Currency Index can offer several ways you can protect your budget, including forward and stop/limit orders which can help protect your costs spiralling out of control in such a volatile and turbulent market.

So, give us a call today and don’t let your pocket be caught out by the market’s movements.

Archive

- 2020 (59)

- 2019 (190)

- 2018 (229)

- 2017 (253)

- 2016 (254)

- 2015 (253)

- 2014 (252)

- 2013 (287)

- 2012 (270)

- 2011 (576)

New Articles

- Brexit deal to be done, or going, going, gone? 25 November, 2020

- Sterling starts the week down from the highs of last week 16 November, 2020

- Votes are in – albeit still being counted, will Donald trump Joe? 4 November, 2020

Categories

- No categories